Arizona’s Jobs Progress Meter Shows Some Strengths and Weaknesses Remain Post-COVID-19

The COVID-19 pandemic and related public health measures, led to the loss of 320,000 jobs in Arizona between March and April of 2020. The state regained all but 50,000 of those jobs by the end of the year, according to the Arizona Jobs Progress Meter powered by data from the Bureau of Labor Statistics.

Arizona’s number of non-farm employees didn’t surpass the March of 2020 number until September of 2021. Recovery time to regain jobs lost in the pandemic varied across Arizona’s Municipal Statistical Areas (MSAs). As shown in Table 1, different regions recovered in varying lengths of time.

The data in Table 1 are not seasonally adjusted, and seasonal changes may influence the variation in recovery time, particularly in economies with significant seasonal variations, like Yuma. Nevertheless, we can gather a sense of the relative strength of each region.

| Location | Number of Jobs in March 2020 | Month of Jobs Recovery to Pre-pandemic Level | Number of Jobs in March 2023 | % Change from Mar ‘20 to Mar ‘23 |

|---|---|---|---|---|

| United States | 149,952,000 | September 2021 | 154,440,000 | 103% |

| Arizona | 2,987,700 | September 2021 | 3,145,400 | 105% |

| Phoenix MSA | 2,218,000 | August 2021 | 2,360,600 | 106% |

| Tucson MSA | 394,400 | November 2021 | 398,700 | 101% |

| Flagstaff MSA | 67,400 | April 2022 | 68,000 | 101% |

| Prescott MSA | 66,200 | August 2021 | 69,400 | 105% |

| Yuma MSA | 55,900 | November 2020 | 60,700 | 101% |

| Lake Havasu-Kingman MSA | 52,400 | November 2020 | 55,400 | 106% |

| Sierra Vista-Douglas MSA | 35,000 | October 2020 (but has since dropped below) | 33,900 | 97% |

Table 1: Job growth data for the U.S., Arizona, and its economic regions show variation in recovery rates from the COVID-19 pandemic. (non-farm, not-seasonally adjusted data)

Examining job numbers in March of 2023 that remove seasonal variability, we can get a sense of which areas of Arizona are relatively stronger markets for job growth. Leading the state are the Phoenix and Lake Havasu-Kingman MSAs, with a 6 percent increase in the number of jobs from March 2020 to March 2023. The weakest job growth occurred within the Sierra Vista-Douglas MSA, which remains below the pre-pandemic job count even three years later. Notably, Prescott is now the third-largest economic region after bypassing Flagstaff.

Satisfaction with job quality can help complete the picture in assessing economic health and potential across our regions.

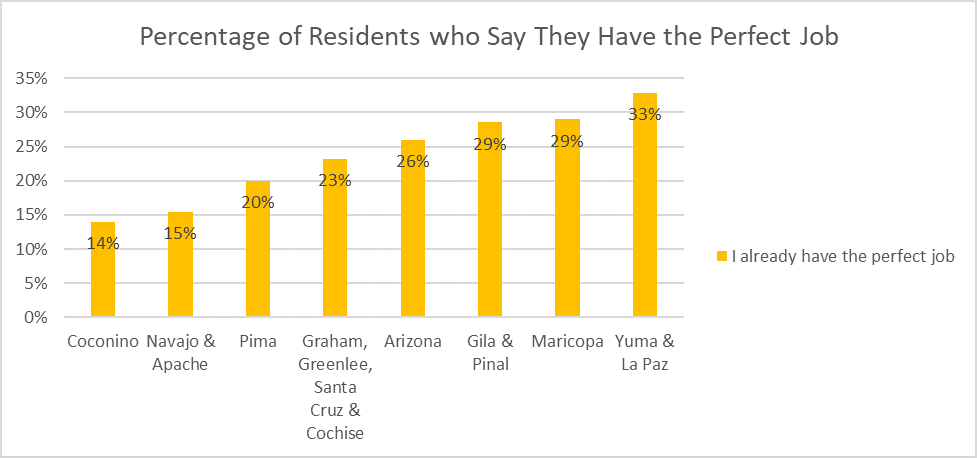

The recent Gallup Arizona Survey asked Arizonans, “What most prevents you from having the perfect job?” The data provides insights into workers’ satisfaction in each region –Regions with higher satisfaction often attract and retain employees, while areas with relatively low satisfaction lose talented workers. As seen in Figure 1, aggregated data from Yuma and La Paz counties had the highest overall satisfaction with one-third of residents indicating they have the perfect job. Maricopa, Gila, and Pinal Counties followed closely with 29 percent. The state average was 26 percent.

Figure 1: One in four Arizona residents say they have the perfect job. Counties with the highest satisfaction were Yuma & La Paz followed by Maricopa, Gila & Pinal.

Looking deeper, this question yields interesting insights into the factors affecting the job market in each county. Below are other responses from the possible selections provided:

- Available jobs do not offer benefits that I need

- Available jobs don’t pay enough

- Discrimination against people like me

- Health problems prevent me from taking jobs

- I already have the perfect job

- I am not qualified for the jobs that are available

- I am overqualified for the jobs that are available

- I do not have reliable transportation to get to work

- I do not want a job right now

- I need to care for children or other family members

- There aren’t enough jobs in my industry

Arizonans as a whole were more likely to say that available jobs don’t pay enough, followed by a lack of availability for job qualifications, then their industry doesn’t have enough jobs available. Looking across regions, we see the following insights:

Top Reasons People Do Not Feel They Have the Perfect Job (Besides Not Wanting to Work)

| Region | #1 Reason | #2 Reason | #3 Reason |

|---|---|---|---|

| Arizona | Jobs don’t pay well enough | Not qualified for available jobs | Not enough jobs in industry |

| Yuma & La Paz | Not enough jobs in industry | Health problems (tie) | Not qualified for available jobs (tie) |

| Pima | Jobs don’t pay well enough | Not enough jobs in industry | Not qualified (tie)/ Care for family members (tie) |

| Navajo and Apache | Need to care for family members | Jobs don’t pay well enough | Not enough jobs in industry |

| Maricopa | Jobs don’t pay well enough | Not qualified for available jobs | Need to care for family members |

| Graham, Greenlee, Santa Cruz & Cochise | Not enough jobs in industry (tie) | Jobs don’t pay well enough (tie) | Not qualified for available jobs |

| Gila & Pinal | Jobs don’t pay well enough | Overqualified for available jobs | Health problems |

| Coconino | Jobs don’t pay well enough | Discrimination | Jobs don’t offer needed benefits |

Table 2: Top three reasons people who want to work but do not yet have the perfect job cite as why their job isn't perfect.

Figure 2: Data indicate a range of concerns that can be addressed to improve employee retention.

Analyzing the data reveals that the primary obstacle for job satisfaction is lower-than-preferred wages followed by a lack of qualifications for better positions and a lack of jobs in the industry of the workers. Misalignment between qualifications and the industries that are available in a region can be solved through economic development activities like attracting employers that need the skills that are available. Communities that have a large number of workers who feel overqualified, like Gila and Pinal, might then look at addressing this gap as a key strategy for retaining quality workers whose skills might be in-demand.

Among the other challenges seen by workers are those related to a lack of services that would enable them to find better work and improve their job satisfaction. Health problems affect 6 percent of Arizonans, along with lack of care for children and family members affecting 7 percent of residents. Also, of concern are the 4 percent of Arizonans who find that discrimination is affecting their job satisfaction, particularly those in Coconino County where 12 percent of residents feel this is a significant barrier.

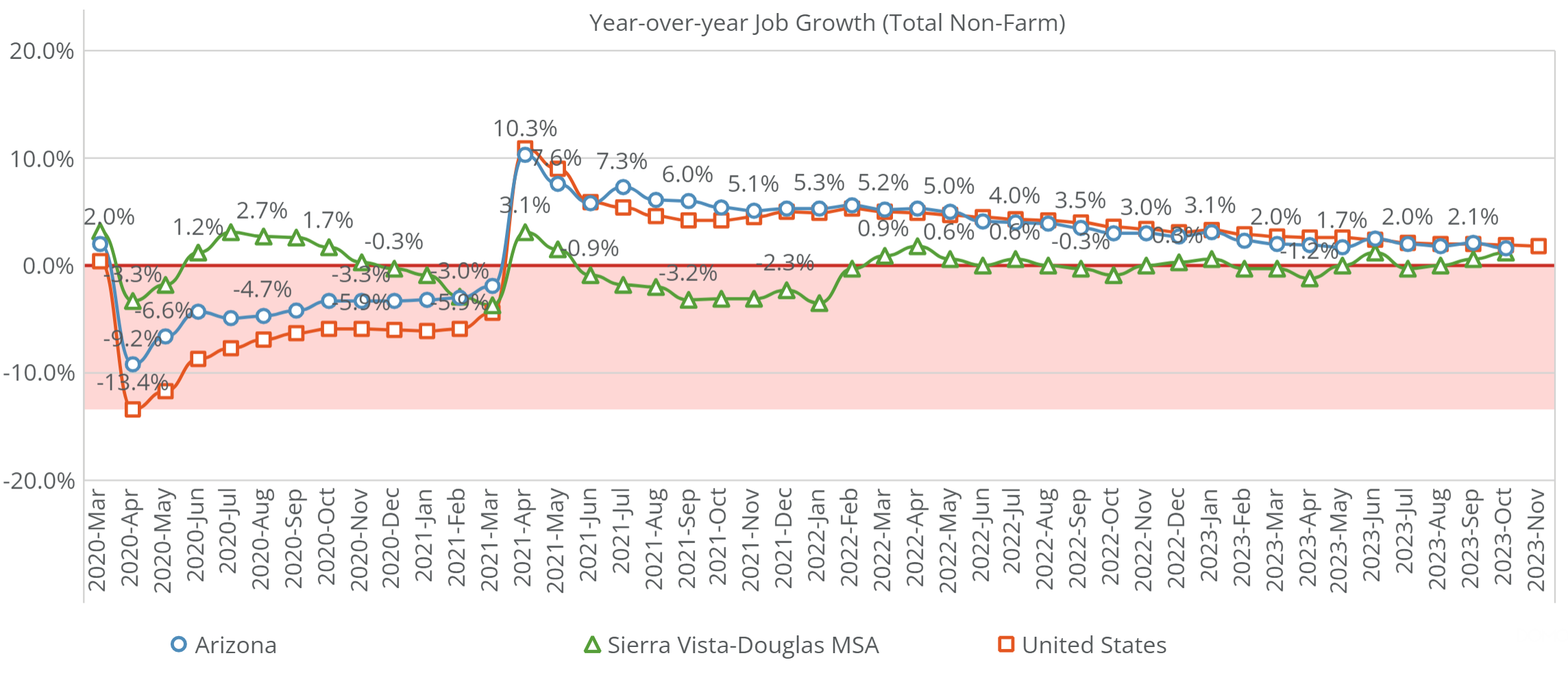

Overall, Arizona’s economic regions have recovered nicely from the COVID-19 pandemic and responsive health measures that caused a significant economic impact in early 2020. Sierra Vista-Douglas MSA (Figure 3) continues to suffer economically despite recovering late 2020. Insights into data from the recent Gallup Arizona Survey indicate that workers have varying levels of satisfaction and that insights into why workers are less than satisfied can be helpful at identifying opportunities to attract and retain qualified employees and attract industry.

Figure 3: Sierra Vista-Douglas saw a much faster recovery from the COVID-19 pandemic, yet the second half of 2021 into the first quarter of 2022 saw a loss of jobs which is still affecting the region.

To learn more, visit the Arizona Jobs Progress Meter which provides insights into five indicators provided by the Bureau of Labor Statistics and other trusted sources. These include Job Growth, Average Wages per Worker, Unemployment, Underemployment, and Labor Force Participation.

The Importance of Job Growth for the Economy

In CFA’s recent Gallup Arizona Survey, only 26 percent of residents said they already have the perfect job. Though it is a high standard, those who are not fully satisfied could take their talents to competing regions, affecting the ability to create jobs and stifling the economic engine in our state. Job growth is an important measure of economic health along with the other measures in the Arizona Jobs Progress Meter.

The Arizona Jobs Progress Meter was developed with the input of experts and stakeholders and was launched in April of 2019. View the data at https://www.arizonafuture.org/progress-meters/jobs/

About Our Data Sources

As with all of the Arizona Progress Meters, data are publicly available from a trusted and regularly updated source. Data used in the Arizona Jobs Progress Meter are sourced from the Bureau of Labor Statistics. Data are updated weekly and additional information are available from the U.S. Census Bureau to illuminate disparities between diverse groups across the state.